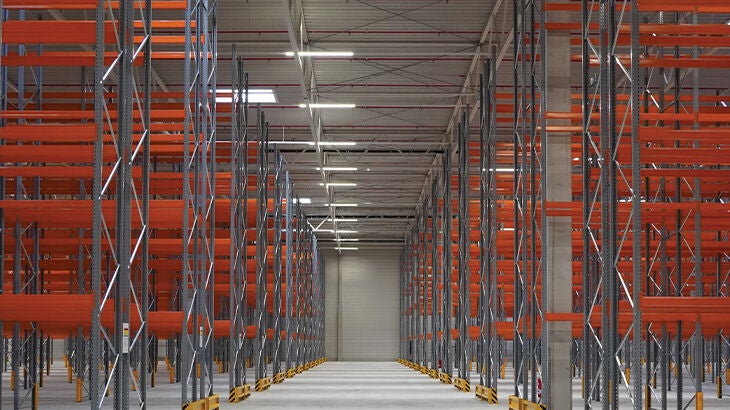

Industrial Workplace -

More people, more space

What impact will the return to net migration gains have on the demand for industrial space?

It’s taking time for the dust to settle in the post-pandemic business world and industrial occupiers are not alone in trying to find a decent balance between what their space needs are today, and what their future requirements might look like.

Recent disruptors aside, New Zealand’s industrial sector was firmly on a growth trajectory prior to 2020, with 24/7 online shopping taking hold and the construction sector forging ahead with a pipeline of new development.

Some of the industrial market fundamentals have changed, while others remain a moving target, but something to be factored into the mix is New Zealand’s evolving population.

Last year, Stats NZ's provisional estimate put New Zealand's population at 5.12 million and, in the year to 30th June 2022, the country not only experienced the lowest natural increase in population since World War II, but the lowest annual net population gain since 1986.

However, the agency said New Zealand had a provisional annual migration gain of +72,300 for the 12 months to April 2023, putting our annual migration gain in-line with pre-COVID levels.

Economists have said that if annual population net inflows settle at around 50,000 to 70,000, there will be upward pressure on residential rents and supply will be very tight, and the same can be said for industrial space, according to Scott Campbell, Bayleys’ national director industrial.

“Solid net migration growth will enhance New Zealand’s appeal for global industrial property investment and will help provide confidence to the development sector which has been cautious,” he says.

“Despite record rental growth and historically-low vacancy levels, the general economic slowdown, high cost of construction, rising interest rates, high land costs and compressed yields have been handbrakes for developers but more people means more industrial space as each additional person creates a needs-driven footprint.

“Net population gains are a positive market driver, they could help offset other market headwinds and may change perceptions around risk-and-return going forward.”

Bayleys’ insights, data and consulting analyst, Ankur Dakwale says in the period between 2001 to 2022, 22.4M sqm of industrial premises were consented for construction.

"Over this same period New Zealand’s population grew – both naturally and through migration – by an estimated 1.24M people.

“This equates to roughly 18sqm of new industrial premises per additional person, although actual construction might be closer to around 12sqm per additional person given that a proportion of consents issued do not get acted upon.”

Bayleys Wellington commercial and industrial director, Fraser Press says in some cases, migration gains may offset elements of sluggishness seen in some sub-markets recently.

“We’ve noted some ‘holes’ appearing in the small-to-medium (SMEs) business leasing segment of the market as a flood of micro-units come to the market, so there’s definitely opportunity for occupiers to secure cost-effective industrial space.

“SMEs are less-bullish around space commitments so the sub-1,000sqm segment of the Wellington market offers scope for start-ups and self-employed contractors to establish a presence in the market at a time when larger occupiers are jostling for premises offering scale.

“Additionally, in some of the smaller regional markets, there’s some existing large scale industrial space coming on-stream due to changing fortunes within certain segments of the market and this could absorb some of the pent-up demand for bigger logistics and 3PL space.”

Press says one of the largest industrial buildings in Palmerston North, purpose-built as the operational headquarters for clothing and homewares retailer Ezibuy which was put into administration by its Australian owners recently, could potentially pivot to a freight and logistics hub given its location within an established industrial estate near the airport and roading arterials.

“Meanwhile, declining print readership globally coupled with cost and supply-chain pressures, and concerns around sustainability and emissions, means satellite operations within the printing sector are effectively becoming stranded.

“National print company Webstar has been down-scaling its Wairarapa operation for several years and plans to consolidate to its Auckland site, leaving 16,000sqm of industrial factory space vacant and ripe for repositioning and adaptive re-use.”

The large-scale industrial occupier market is not a level playing field with nuance between market segments so while New Zealand's two biggest supermarket chains, Foodstuffs and Woolworths New Zealand Limited have been on the expansion trail and opening new stores around the country, other corporates are pushing pause.

NZ Post’s ecommerce spotlight report has highlighted that there has been a slowing in online shopping patterns, but a larger population base could alter dynamics once more.

The Productivity Commission’s Immigration - Fit for the Future report recommends that Government develop a Policy Statement for immigration, which in conjunction with natural population growth projections, would allow the country to better plan for future infrastructure, and services.

Campbell says this sort of intel would be useful for industrial business planning, and with migration dynamics dependent on both economic cycles and changing policy settings, and with the significant uptick in new residents this year, some businesses are grappling with space projections in major centres.

“New migrants typically gravitate to the Auckland region in the first instance, and while it is likely that the Auckland market will continue to be under pressure to supply future industrial stock, particularly for logistics and warehousing, the tight rental housing market could be a deterrent and see more movement of people around the country.

“In September 2022, it was reported that around 11,000 employers had applied for accreditation to bring in almost 53,000 migrant workers, and in March of this year, the New Zealand Infrastructure Commission said the total value of infrastructure projects in the pipeline stood at $92.3 billion, an increase of 17 percent from December 2022.

“Around 40 percent of these projects are for the provision of healthcare, education, community facilities, and social housing infrastructure so fundamentally the country is changing, and the industrial property sector will need to adapt accordingly.”

Campbell says pressure is expected to remain on industrial space in the short-medium term and occupiers are urged to start the run-up to new space well-ahead of lease expiry to secure optimal premises that meet current and projected business goals.