Rural Insight -

Viticulture Market Insights June 2025

Biggest trends

Sauvignon blanc dominance and market pressure

Sauvignon blanc remains New Zealand’s export leader, but the large 2025 harvest adds to existing oversupply. Despite good quality, prices remain weak, and new U.S. tariffs add pressure. Producers are cautious - margins are tight, and global uncertainty clouds recovery prospects.

Contracted supply as a safety net

Secure supply contracts are now critical. Wine companies favour predictability over flexibility, sidelining uncontracted vineyards. In a risk-averse climate, contract length, price certainty, and partner strength are essential for resilience.

Vine renewal and efficiency investments

With many vineyards maturing, replanting is needed but costly. Growers are investing in new spacing and varieties to match market shifts, though capital constraints slow progress. Climate unpredictability makes gains in efficiency both vital and harder to achieve.

Outlook for the next 12 months

Export market stabilising, cautiously

Export volumes show signs of steadying, but growth expectations are muted. Stockpiling in key markets lingers, and economic and regulatory uncertainty keeps buyers conservative. Many producers now prioritise stability over expansion.

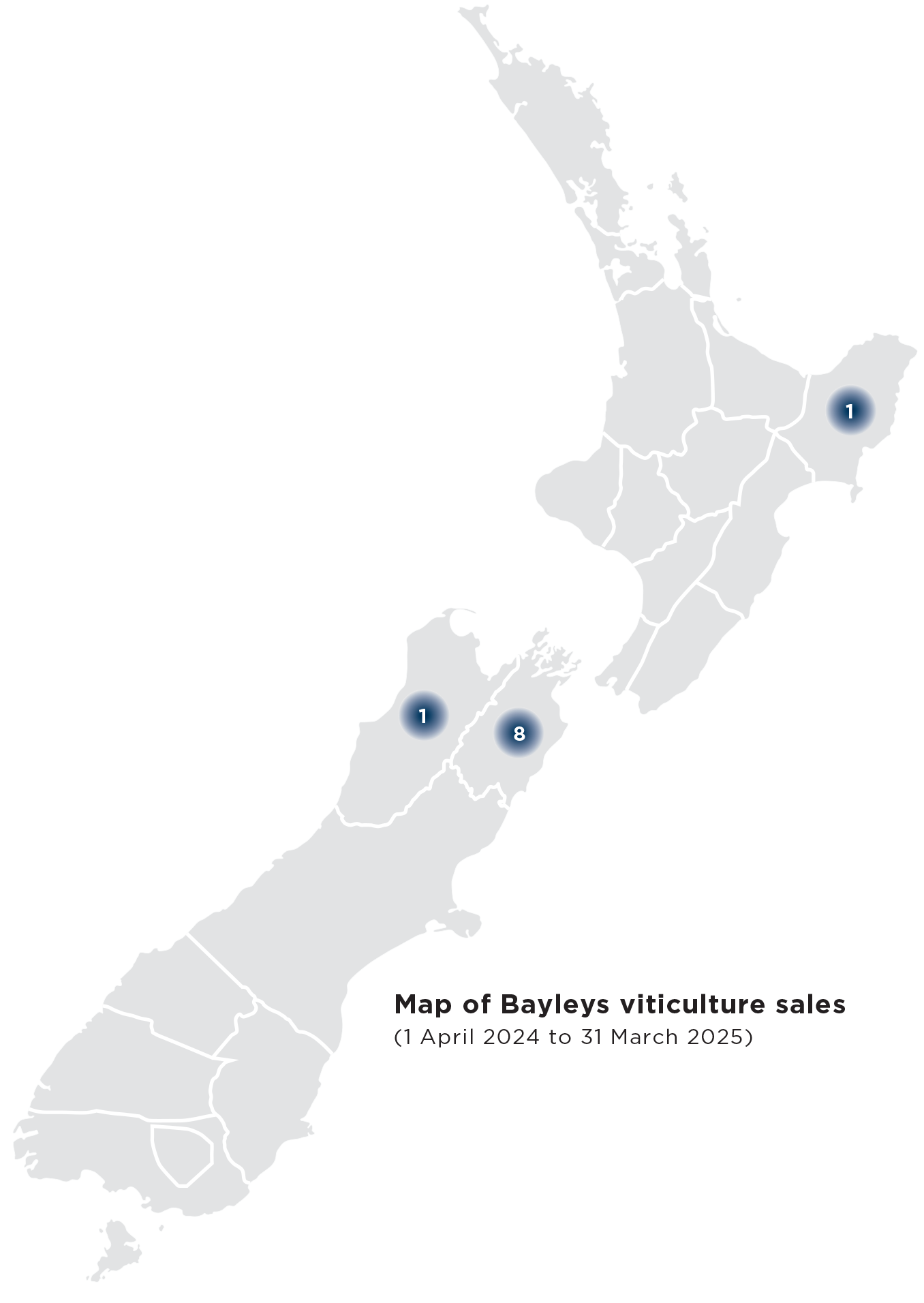

Vineyard buyers becoming selective

Investor interest has cooled, especially from institutions. While long-term land value appeals, recent price corrections and market volatility prompt more cautious decision-making, particularly for scalable operations.

Lifestyle buyers remain active, but cautious

The $1.5M–$3.0M segment stays engaged, driven by lifestyle and mixed-use appeal. Yet even this resilient group is showing more price sensitivity, favouring flexible, value-driven investments.