Investment Environment Improves

Firstly the Government confirmed that it would not pursue a Capital Gains Tax (CGT) at the next election, removing the uncertainty that had surrounded the issue since before the 2017 election. Secondly the RBNZ, in May, cut the Official Cash Rate (OCR) to 1.5% an historic low which resulted in banks further trimming mortgage rates. This move follows the easing of Loan to Value Restrictions in January.

The threat of a CGT being lifted will clearly add to the confidence of investors who can now make purchases knowing that any gain they make at a future sale will be tax free, assuming of course, that the bright line period of five years has lapsed.

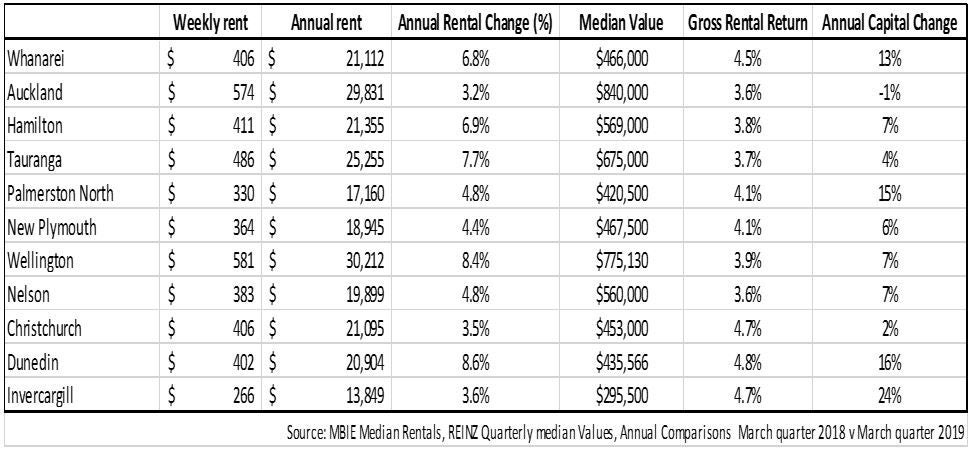

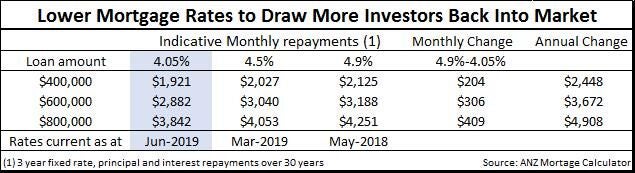

The reduction in the OCR has seen mortgage rates being trimmed thereby reducing monthly repayments. As the table below illustrates monthly repayments for three year fixed rates have fallen over the last year. Rates of just over 4% are now being advertised by the major banks, this rate is almost 50 basis points lower than those readily available in March and down approximately 90 basis points over the last year.

Deposit Rates also Fall

The fall in interest rates while benefitting those servicing loans has had an adverse impact on savers. Deposit rates have also been cut meaning returns from “money in the bank” have fallen. This dual impact from OCR cuts will lead to many savers looking to move funds to higher yielding assets including residential property.

Other Drivers Remain in Play

When considering the Auckland market the fact that values have been in a holding pattern over recent times with an easing of values evident in some locations has also seen affordability concerns easing. With the region’s median value all but unchanged over the last two years and wages having seen mild upward pressure affordability measures have improved.

Demand for housing continues to be strongly supported by high levels of migration. Recent figures from Statistics New Zealand, while somewhat volatile following a change in the way the numbers are calculated, have shown the view that migration would fall sharply following the last election to be incorrect. Over the year to March 2019 the net migration figure was estimated at 56,100 still well ahead of the 10 year average of approximately 31,850 pa. The impact on demand is felt most acutely in Auckland which has traditionally housed between 50% and 60% of the net migrant flow. The continued elevated levels of population growth is clearly seeing the tenant pool expanding at a time when the additional demand for property continues to run ahead of new supply.

Many of the market fundamentals therefore remain strongly supportive leading Treasury in its pre budget forecasts to project average annual growth of approximately 4%-4.5% over the next four years nationwide.

Should Treasury’s projections prove to be correct this would clearly positively impact the “total return” generated by residential property investments.

Rents on the rise – Lifting Returns

Rentals across the country have been trending upwards with the national median reaching a new record high of $500 per week for the first time in April according to the Trade Me Rental Price Index.

The findings are supported by figures released by Statistics New Zealand in its April rental price index which show national rents to have increased by 4.4% with the Auckland index up 2.4%

According to the Trade Me figures rents in six of the country’s regions reached new record levels in April.

In Auckland the regional median hit $560 per week according to the Trade Me index.

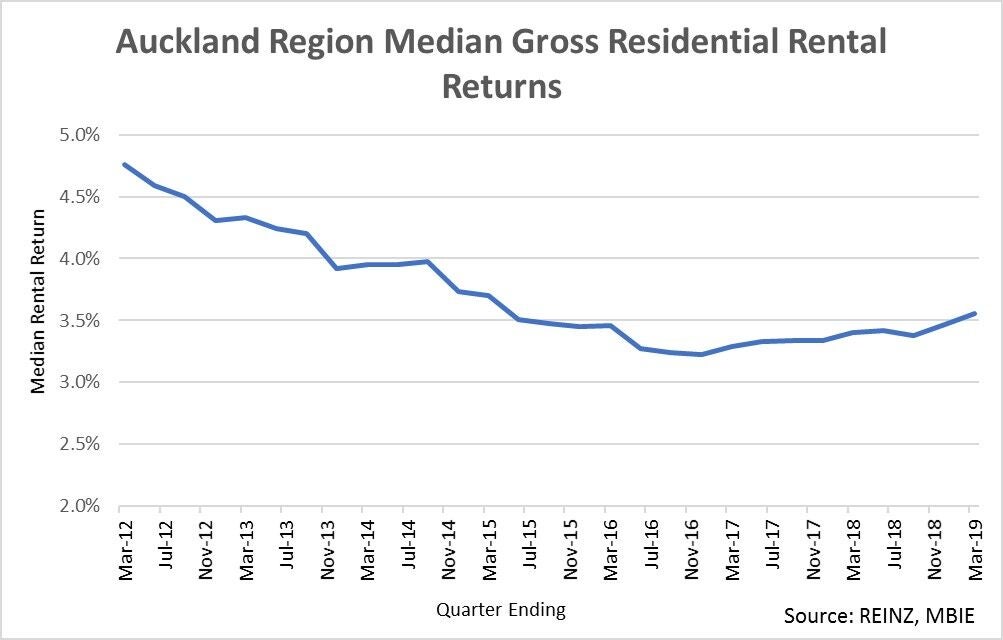

Combined with the consolidation in property values the lift in rents has seen gross rental returns trending upwards having reached a cyclical low in late 2016, the result of sharply rising capital values. Based upon median sales prices and median rents, investment property in the Auckland region generated a median return of 3.6% in the March quarter of 2019 up from the 3.2% being generated in late 2016. Prior to the surge in property prices which occurred between 2012 and 2016 median rental returns were as high as 4.8% as illustrated in the graph below.

Note:- Graph based upon Real Estate Institute of New Zealand (REINZ) quarterly median residential sales values v median regional weekly rent provided by Ministry of Business Innovation and Employment (MBIE)

As the graph above shows initial gross rental returns from residential property have generally sat at between 3% and 4%, however are, as a result of the recent reduction in deposit rates competitive with the returns being achieved from bank deposits and in line with mortgage rates presenting a more attractive scenario for investors, particularly given that rental returns are only part of the overall picture.

Total returns also take account of any capital return generated by the market. While Auckland values have been under mild downward pressure over the last couple of years this follows an extended period when values were surging, generating double digit capital returns over four successive years peaking in the year to March 2015 at 14% according to REINZ statistics.

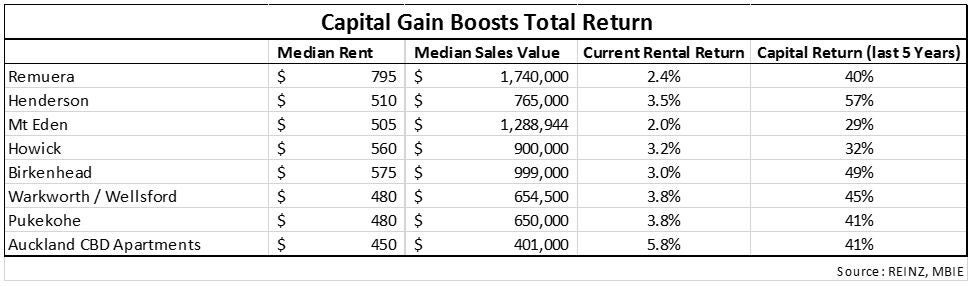

Median returns however tell only part of the story with different suburbs generating higher or lower returns. As a general rule rental returns rise as you move further from the CBD, given that property values tend to reduce. As illustrated in the table below the median gross rental return on a Remuera based property over the six months to April 2019 was 2.4% while in Henderson the figure was 3.5% and in Pukekohe 3.8%.

Bucking the, distance from city centre trend are, ironically, apartments located within the CBD itself. These have traditionally delivered higher rates of rental return and the latest figures show this to be continuing with the median return sitting at 5.8%. As with the suburbs which generate the higher returns the 5.8% reflects the more affordable entry price. The trade off is that while the capital return has matched that of Remuera in percentage terms the dollar value of the gain, based upon median values, was $116,000 over five years compared with the $495,000 seen in Remuera.

Regional Centres offer Opportunities

Investors looking for a more affordable entry point to the investment market may find regional centres of interest.

Median property values are generally lower in regional centres and, as discussed earlier, rental levels have been on the rise with Trade Me advising that new record levels had been reached in the Bay of Plenty, Hawke's Bay, Manawatu/Whanganui, Southland, Taranaki and Waikato in April.

While capital values have consolidated in Auckland many cities outside of Auckland have continued to enjoy capital growth over the last 12 months as shown in the table below.